Analytics - 2019

TOP101 from Crisis to the Advancement

The announcement of results of the most valuable Latvian companies TOP101 this year coincide with the fluctuations of global economy, and more and more often in different authoritative mass media devoted to financial and economical issues it is possible to meet the words – recession, crisis, stagnation, and the like. There are different reasons for that – US-China trade war, approaching Brexit, economical difficulties of Germany, considerable slowdown of the growth rate of China, etc.

This sentiment gradually enters also the minds of people from Latvia – they analyze, whether Latvia will suffer from these global threats, and, if it would become true, how severe will it be – will it slow down the rates of our GDP development, or, perhaps, GDP even will decrease. The previous financial crisis of 2008-2010 had a very severe impact on Latvia; more than a decade has passed since the beginning of crisis, and there is a reason to find that the economy of Latvia, being open and oriented towards export, will be pulled into this whirl of global economical instability.

Without assuming the responsibility for forecasting the exact changes of Latvian economy during the coming years, TOP101 of Latvian most valuable companies, which is prepared already for the 14th time, enables to study the historical data about the correlation of Latvian economy and the value of Latvian most valuable companies. It enables to see, how the most valuable companies of Latvia have survived during crisis, how it has affected their value, what sectors suffered most, and which ones have adapted to the post-crisis market situation most successfully, as well as it is possible to think about the most important problem – whether TOP101 reflects the economy of Latvia.

Correlation of TOP101 Total Value and GDP

There are legends about the year 2007 or the year of pre-crisis like the best year in the economy of Latvia; for many years it was considered as the reference year that shall be reached. As we can see below, Latvia’s GDP in real prices reached the pre-crisis level in 2015, but in reference prices – only in 2017 or it took a decade.

But TOP101 shows a different picture – although the total value of the most valuable 101 Latvian companies following the decline of two years started to increase only in 2010 – like the economy of Latvia, the pre-crisis value was exceeded 4 years earlier – already in 2013. Although it is impossible to identify any particular reason for such difference from the economy of Latvia, the main factors for the success of companies comprised in TOP101 list might be a company’s size, professional management and an opportunity to invest also under the crisis situation.

At the same time the amount of TOP101 total value of Latvia’s most valuable companies since the stable rapid increase shows stagnation to some extent, because the value of TOP101 companies remains within the limits of EUR 17-18 billions. As we can see below, it is mostly “due to” state capital companies the total value of which in TOP101 has even decreased in comparison to the situation a decade ago. At the same time TOP101 of 2019 also indicates the halt of the increase of the value of private capital companies, which, probably, already now reflects hindering of global economy.

The Decrease of the Post-Crisis Value of Financial Sector has been Successfully Replaced by Other Sectors

Having performed the comparative analysis of sectors, we can see a very interesting picture – financial and banking sector has lost its dominant sector’s role in the list of TOP101 since 2007, and although the economy recovered during the later years, the role of financial sector has not been determinative, irrespective of the fact that there had also developed the companies of non-banking financial sphere.

At the same time considerable increase of value have achieved companies operating in the spheres of consumer services, processing industry and trade. This enables to draw a conclusion that TOP101 of the most valuable companies of Latvia, according to sectoral analysis, is well-diversified, based on both export of high added value and considerably more powerful domestic consumption. If such balanced sectoral structure would be extrapolated in relation to all economy of Latvia, we could draw a conclusion that the economy of Latvia has well-prepared for the expected shock of global economy.

The proportion of the value of state sector companies in TOP101 also proves that the economy of Latvia now considerably differs from the situation in 2008. The drastic decrease of the value of banking sector brought financial crisis, and in 2010 the proportion of TOP101 state companies in the total value reached 43%. At the same time, irrespective of the fact that several private capital companies included into TOP101 list in 2010 did not survive the following years (Parex banka, Liepājas Metalurgs, Trasta Komercbanka, Nelss, etc.), all-in-all the proportion of private capital companies of TOP101 has gradually increased, while the total value of state companies in absolute figures has decreased during this decade – from EUR 4.4 billions in 2010 to EUR 4.2 billions in 2019.

As we can see, the increase of the total value of TOP1 during the decade following financial crisis has ensured the rapid increase of the value of private capital companies, with the total proportion reaching 75% in comparison to 57% in 2010. This fact only again emphasizes the ability of private entrepreneurs to adapt faster to the market changes, to take decisions based on the development, as well as it indicates the main role of companies’ management – to ensure for the owners the increasing company’s value under any economic circumstances.

Through Thorns to Stars – the Most Rapidly Growing TOP101 Companies Since Crisis

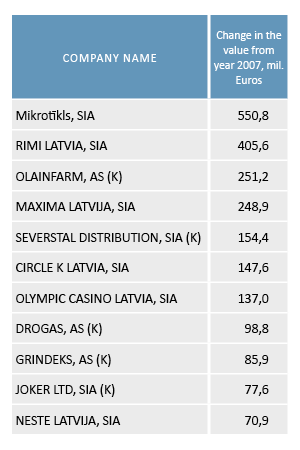

There are companies in TOP101 list of most valuable Latvian companies, the value changes of which since 2007 perfectly show that during crisis there had been taken correct, towards development oriented decisions, ensuring rapid increase of the value of these companies. During last decade the champion of TOP101 is the company Mikrotīkls, which has managed to increase the company’s value by EUR 550 billions, moving up from the 51st place to the 3rd place in the list for 2019.

10 most rapidly growing companies shown in the table together have increased value by 2.3 billion EUR, irrespective of the fact that 5 of these companies (including Severstal Distribution, Drogas) in 2010 even dropped out of TOP101. Every company’s success story differs, but they all have in common the fact that their management and owners have managed to use the opportunities offered by crisis, and such rapid increase of value indicates that the decisions taken have been well-considered. We should also to note the fact that in this period only one state capital company - Latvenergo – showed greater increase of value than Mikrotīkls; considerable increase of value could achieve also Latvijas Valsts Meži and Latvijas Dzelzceļš.