Analytics - 2015

With the publication of TOP 101 2015, it will be ten years since the TOP101 of Latvia's most valuable companies has been published. In these ten years we've looked through over 4500 annual reports and right now we can look at the TOP101 of Latvia's most valuable companies no just in comparison to the previous year, but in ten-year perspective. This year again brings over 10% increase in the total value of the TOP101 companies. It must be pointed out that after the sharp decrease of the value from 2008 to 2010, since 2011 the company value has increased annually by on average 9%. Interestingly enough, this year there are 43 companies among the most valuable, which have entered the TOP101 already in 2006.

Similarly as last year the TOP101 entry threshold has grown from approximately 38 million last year has increased by 17% resulting in a company value of 44 million euro, required to enter the 2015 top. Furthermore, comparing this threshold with 2006, we see a rather significant increase – in 2006 the entry threshold was only about 12.8 million euro, which is 3.5 times less than now. It must be pointed out that the increase of the total value of TOP101 companies comprehensively reflects also the changes in each company's profit performance and corporate governance. Thus, it can be concluded that, after the first five rather inconsistent years TOP101 shows positive growth in the five next.

This year one of the TOP101 characteristics continues to show – every year there is a stable level of rotation, this year both TOP10 and TOP20 includes one new company, but the top as whole includes 13 new companies. Part of newcomers has been included in the top in one of the previous years or are related to some of the previous top companies. Completely new additions to the top this year are SIA RIGA FERTILIZER TERMINAL, SIA GREEN TRACE, SIA BITE LATVIJA, SIA BFIII LATVIA and SIA AKSELSS. In total, excludng the newcomers, 59 companies show increased value and the average value growth is 19%.

Looking at TOP10 flagship companies, several interesting characteristics can be observed – significant historic stability with new breezes of development felt on the tenth anniversary of the top.

Stability – five out of ten most valuable companies, i.e. AS Latvenergo, AS Latvijas Valsts meži, AS Latvijas gāze, SIA Lattelecom, SIA Latvijas Mobilais Telefons, have been in the TOP10 for all ten years.

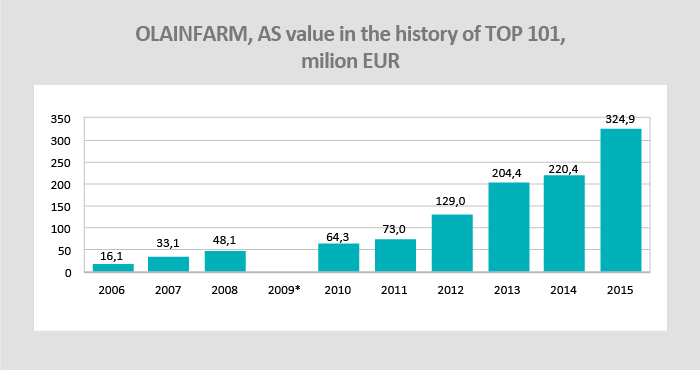

Growth – this year's first ten positions of TOP101 includes also AS OLAINFARM, which is an important success story in the ten year history of TOP101. In 2006 OLAINFARM with the value of 16.1 million occupied the distant 86th place, while this year, with the value of 324.9 million euros it takes the tenth position, showing how significant an increase is possible in ten years' time. The ten year history of top confirms that also the next ten years may see new development, and companies that have never been listed among the Latvia's most valuable companies TOP101 or currently is far behind the top ten may reach the TOP10.

*information about the company value is not available, as in 2009 AS Olainfarm was not included in the TOP101 of most valuable companies

The remaining four most valuable companies has shown significant stability, as they have been included in at least nine previous tops, never below 25th place.

Disregarding the stability of the ten most valuable companies, the TOP101 as whole shows a trend that the value proportion of the first ten companies is decreasing – from 50% in the distant 2006 to 40% this year. Interestingly, the second top ten companies (11th to 20th position) have kept their value proportion relatively intact (16% in 2006 and 17% this year). The biggest increase is seen for the smallest companies – 81 company from 21th to 101th place in ten years of the top's existence have increased their value proportion from 34% to 42%. Thus, the increase of the value proportion of comparatively smaller companies is a continuous trend. Besides, not only the value proportion of the smaller companies is growing, but also their average value to one company – the owners of the 51th to 101th place have seen its growth from 2006 by almost three times or from 21 million euro in 2006 to 57 million euro this year.

In the ten-year perspective the TOP101 shows that stable leaders among the industries are the financial services, transportation and logistics, communal services and processing industry (industrial production), where each of them has over 10% value proportion in the top. Remarkably, this year has seen a significant growth of the proportion of the IT and telecommunication industry and trade (consumer goods industry); thus, making a change in the leading industries a possibility.

This year seven of the industries represented by the top has seen a value increase. The largest growth can be found in financial services and transportation, transit and logistics. Transportation, transit and logistics have grown by 368 million euros, which is a little more than 16% compared to the previous year. This can generally be explained by improved financial performance of the companies and positive mood in the European finance markets.

Finance services have grown this year by 645 million euros or 28% compared to the previous year. The main factors promoting the growth of industry value are increase bank own capital and positive situation in the European finance markets, which has resulted in not only increased value of the financial services companies in the previous top, but also four new companies related to finance industry entering the top this year.

Similar situation related to increased financial performance can be seen in the TOP 101 in general – out of 85 companies unrelated to financial services 56 have increased their turnover compared to the previous year and 49 have increased EBITDA. Unfortunately, the number of companies with increased financial performance is smaller compared to the previous year. Also, the aforementioned growth has not been too significant – the turnover change median of all 85 companies has been only plus 4%, the EBITDA change median – only plus 3%. As a result, part of the total increase of TOP101 company value by 10% is mainly due to the favorable situation in the European finance markets.

Without regard to the tense geopolitical situation, which has significantly affected the company activity in 2014, the companies have been able to adapt to the market situation and, in general, the year 2014, the results of which are reflected in the 2015 top, has been a successful one. Reviewing the TOP 101 in ten-year perspective, it is clear that companies in Latvia are able to adapt to even the most complicated market situations, showing endless aptitude for development and fighting spirit. Thus, in the further future, especially – looking back at the growth in the last five years, positive trends are to be expected.